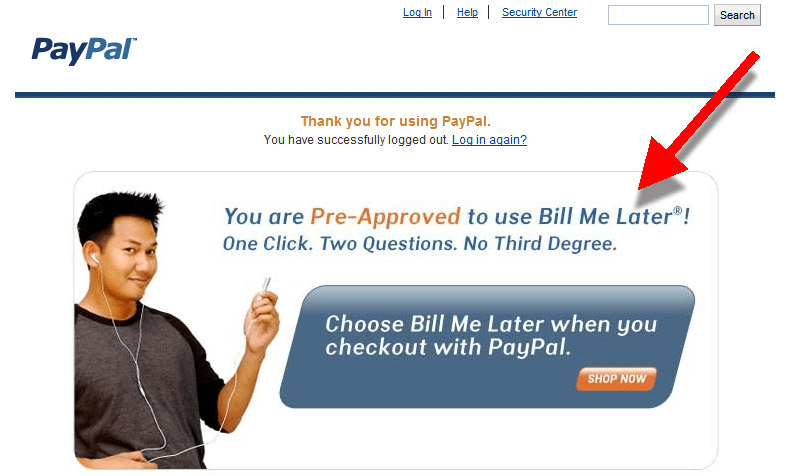

PayPal is opening up its Bill Me Later service to small and medium online businesses, enabling them to offer free no-interest financing for six months for all purchases of $99 or more. Bill Me Later will give small business owners a way to increase sales conversions and boost order sizes going into the holiday season. And it expands the utility of Bill Me Later to merchants who have never been able to offer instant financing. For merchants who participate, they will be able to offer Bill Me Later as an option at checkout and will get paid right away from PayPal. There is no upper limit for how much people can finance using Bill Me Later, and the transaction is approved or denied within about one minute. If a consumer takes longer than six months to pay off their purchase, they will pay an annual percentage rate of 19.99 percent.

This should be helpful for consumers who might be a little hesitant to make bigger purchases due to the tough economy. For businesses, offering Bill Me Later could push someone to add a few more items to their shopping carts if they’re short of a the $99 threshold. Forrester Research found that 43 percent of Bill Me Later sales are in addition to regular online sales and offering Bill Me Later boosted average order sizes by as much as 75 percent.